A list of grants available for self-builders and home improvers who are looking for financial help building their home or upgrading it in Ireland today.

In this article we cover:

- List with links of what grants are available in Ireland today

- Energy upgrade grants

- Vacant property grant

- What fiscal incentives exist

- What utilities have to offer

- Grants for traditional buildings

- Adaptation grants

- Oil buying clubs

- Low income schemes

Republic of Ireland (ROI)

Sadly, there are very few grants available for new builds, apart from the EV charger grant and the Help to Buy which is a tax-back scheme. EV chargers are now mandatory on all new builds.

1. Individual Energy Upgrades and One Stop Shops (OSS)

For those looking for grants to do up the energy efficiency of their home, there are two main grants available.

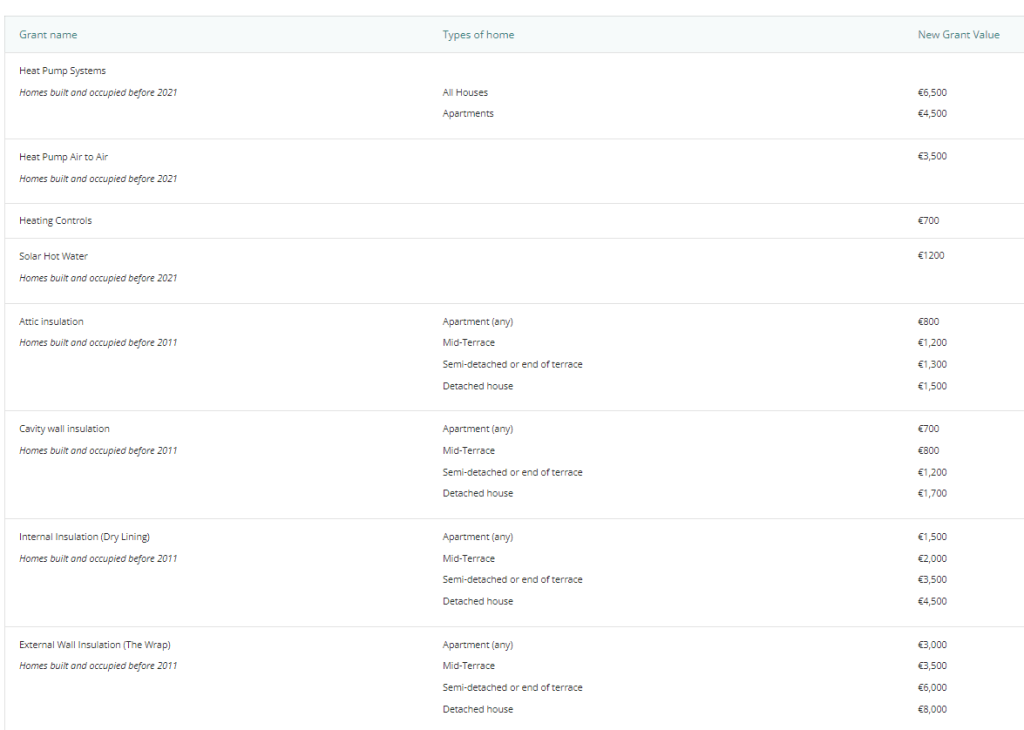

Individual energy upgrades are individual grants for insulation, solar thermal panels, boiler upgrades and controls, and are available for homes built before 2011. A contribution towards your Building Energy Rating in the context of the work is also available. For heat pumps and renewable systems, the house must have been built before 2021. Note that grant amounts for solar PV decrease every year.

The current grant amounts are below, as of August 2024:

The One Stop Shop grants subsidise a whole house energy upgrade, including windows and ventilation system. While there’s more on offer in terms of grant amounts, the overall cost/commitment is greater too. According to the SEAI (see below) for a detached house to get from E1 to A2 typically costs €63,837, minus the typical grant amount of €23,700, making the homeowner €38,058 out of pocket.

Most utility companies are now offering supports by facilitating or being a One Stop Shop, e.g. Electric Ireland Superhomes. Some even offering loans to get the work done, e.g. Energia’s Cosy Home scheme.

Government-backed low-cost loans are now available for those looking to get an energy upgrade done.

2. Fully Funded Energy Upgrades

Formerly known as the Warm Homes Scheme, these are free energy upgrades for families receiving government supports such as fuel allowance. See SEAI website for more.

3. Fiscal incentives

The Help to Buy scheme helps first-time-buyers put down a deposit to build their new home or to buy one. For a self-build you will need a solicitor to do the paperwork for you and it’s a tax back scheme, so you need to have paid taxes the previous four years.

See the Revenue website for more details.

The scheme is currently available until December 31, 2025 and will be extended another five years.

PV panels are now also tax exempt.

4. Vacant Property grants

You can get €50k for a vacant property or €70k for a derelict property to do it up – you can already own the property or be in the process of buying it. And it can be a renovate-to-rent project; you don’t have to live in it. Find out how to apply here. There are loans available to those who apply for these grants too.

The Repair & Leasing scheme will give you a loan to repair a home you own that has not been lived in for at least a year – up to €40,000 (or €50,000 for what was previously a bedsit) – with a view of renting it out for social housing purposes. The minimum social housing lease term was reduced from 10 years to five years. The loan is paid back over the term of the rental agreement; also if you choose to act as landlord you can pocket more of the rent than if you were to get the local authority to act as landlord. More information here.

Broader supports are available for vacant properties here.

5. Traditional buildings grants

The Traditional Farm Buildings Grant goes towards the conservation and repair of traditional farm buildings and related structures for farmers in the Green Low-Carbon Agri-Environment Scheme (GLAS). Maximum grant amount is now €30,000; up to 75 per cent of the cost can be financed subject to the maximum grant amount. Grant amounts can be as low as €4,000 depending on the project.

A thatching grant is available towards the cost of renovating thatched roofs of owner occupied houses. A grant of two thirds of the approved cost up to a maximum of €3,810 is available.

For heritage buildings in need of considerable repair there are two grants available but these can be hard to get: the Structures at Risk Fund, with funding between €15,000 and €30,000 available, and the Built Heritage Investment Scheme which funds up to half of the total project cost. Contact your local authority for more information. A tax relief may be available too (Section 482).

6. Adaptation grants

These are means tested, there’s the Housing Adaptation Grant for People with a Disability with a maximum grant amount of €30,000 or 95 per cent of the cost, the Housing Aid for Older People with a maximum grant of €8,000 or 95 per cent of the cost and the Mobility Aids Grant with a cap of €6,000 and this grant can cover 100 per cent of the cost.

Fully funded grants, or up to €5,000 whichever is lower, are available to replace old lead pipes.

Also available is a grants up to €4,000 to replace your septic tank after failing an inspection. This grant is under review to be extended to everyone deemed to be in high risk areas. In practice, this grant is very hard to get.

7. Feed in tariff for renewables

After years of waiting, you can get paid for the electricity you export under the Microgeneration Support Scheme (MSS) plus a tax break on what you earn form it.

Northern Ireland (NI)

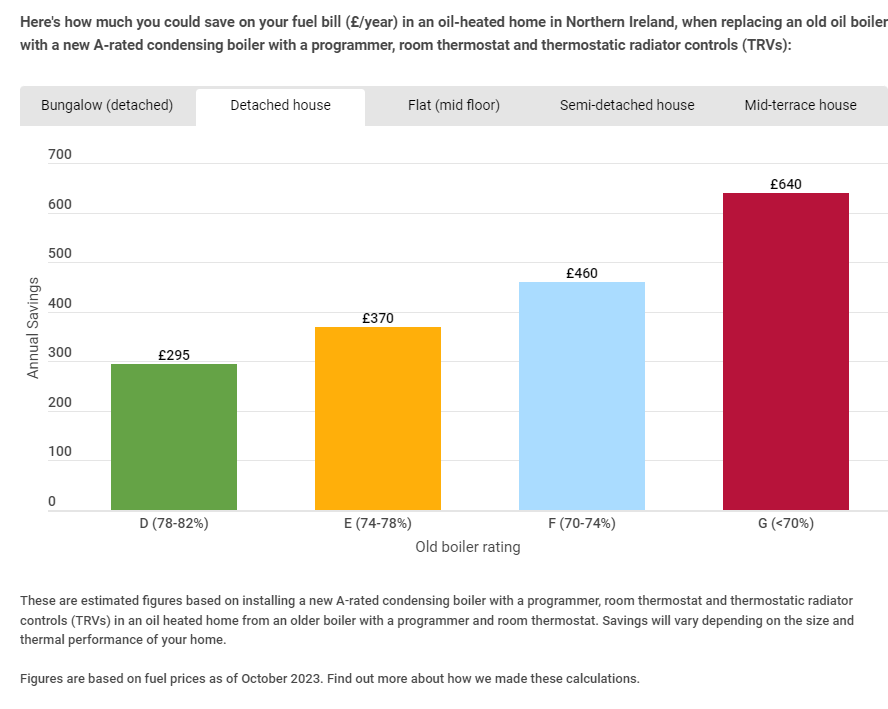

Savings to be made in NI with replacing a boiler are available from the Energy Savings Trust, as below:

1. Feed in tariff for renewables

The Northern Ireland Renewables Obligation Certificates (NIROCs) scheme was closed in April 2017 so there is no longer a financial incentive from the government to generate your own electricity from solar (photovoltaic – PV) or wind.

However you can still get paid for the energy you export to the grid with what’s referred to as an export payment; you must have an NIE Networks import / export meter fitted to allow you to do this. Export payments from Power NI are 14.22 p/kWh until September 30, 2024.

Great Britain has a different regime; there the Smart Export Guarantee replaced the now defunct feed-in tariff system. The Smart Export Guarantee is GB only so does not apply to NI.

2. Tax rebates

New builds in NI are exempt from paying VAT. You must apply for the VAT back at the end of your build, having kept every receipt. This zero VAT rate is available to self-builders (new builds).

You can also get the VAT back on conversions and change of use where the property has not been occupied for 10 years. Homes that have not been lived in for at least two years prior to works commencing qualify for the reduced VAT rate of 5 per cent; useful FAQ here.

The zero VAT rate also applies to work done for someone with a disability or terminal illness.

The reduced rate VAT of 5 per cent applies to mobility aids, heating and security work for people over 60.

3. Oil buying club

Group with your neighbours to get a better deal from oil suppliers to fill your tank. More information on the NI Oil Buying Network here.

4. Housing Executive grants

There are a number of grants available for houses in a lot of need of repair, but these tend to be very hard to get. Ulster Architectural Heritage has also published a helpful overview of the grants you could apply for if you own a historic building.

For those with mobility or disability issues there’s the Disabled Facilities Grant which could see all of the works recommended by an Occupational Therapist funded (typically up to £35,000, absolute max of £70,000). A Replacement Grant can be applied for in conjunction with the Disabled Facilities Grant; maximum grant is £31,500 for a dwelling up to 80sqm.

For those on a total annual gross income of less than £23,000, there is the Affordable Warmth Scheme, run by the NI Energy Advice Service (NIEAS) – tel 0800 111 44 55, email: NIenergyadvice@nihe.gov.uk.

There are more options but many are hard to get; further information on NIHE grants here.

5. Low income schemes

Bryson Energy in partnership with Belfast City Council runs a handyman service for the elderly. More here.

There are additional grants available through the Utility Regulator’s Northern Ireland Sustainable Energy Programme. Details for the schemes in operation until March 2025 are below:

Many of these measures are fully funded, including to upgrade to an efficient heating system and to carry out insulation upgrades. Note that these are only open to those on a low income, i.e. single person household with income / pension less than £28,000 before tax or couple / single parent family with an income / pension less than £35,000 before tax.

Disclaimer: This list is not exhaustive, always consult with a qualified building professional. Schemes are subject to change.

Last update: August 2024

Try our ‘Selfbuild Cost Calculator’. Fill in details and instantly get a rough estimate for your project